Year 2 Of Tight Credit: Private CRE Investors Continue to Ponder the “New Normal”

June 6, 2024

Year 2 Of Tight Credit: Private CRE Investors Continue to Ponder the “New Normal”

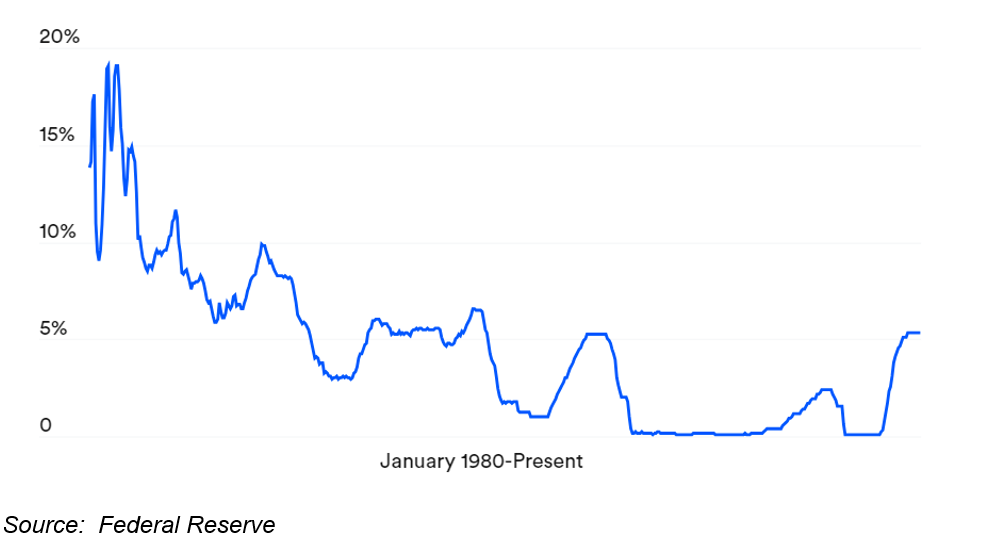

With the cost of capital still elevated, the Fed may be saying “Get used to it!”

It is usually a bit dicey to look back at something we wrote a year ago, but we did it anyway. It has been 12 months since our May 2023 article looked at the extent to which the Fed’s inflation-busting rate hikes were taking their toll on transaction activity.

Coming off a decade of growth fueled in large part by a long run of low interest rates, the market was reeling. Some called for private CRE asset values to be written down substantially at the outset to reflect the new cost of capital, mirroring to some extent what transpired for public REITs. This approach was understandably an anathema to most private CRE fund managers whose livelihoods (i.e. management fees, performance, and ability to raise capital) depend on maintaining healthy asset values. The default therefore, was to go into ”wait and see” mode: there was hope that the FOMC rate hikes would tame inflation and rates would come down.

The “New Normal”

Unfortunately easing by the Fed has not materialized. A year later, the market realizes that the ‘new normal’ might look very different from the low-rate decade. Currently, even the most optimistic projections point to a “normal” rate closer to the 50-year, 4.41% FOMC mean (taking account of the record highs of the mid-1980s).

So Now What?

The headline of almost every current real estate market update tells us that still-tight credit is causing constrained transaction activity. For real estate funds, higher interest rates have become a fact of life. Private real estate valuations are continuing a slow downward march as evidenced by the 10.9 percent drop in the appreciation component of the NCREIF Property Index for the year ending March 31, 2024. With few signs of relief on the cost and availability of debt, the standoff between buyers and sellers continues and the bid-ask spread remains wide. Cash-rich buyers are looking for bargains on distressed assets, yet so far fire sales have been relatively scant. In this market, creative financing is flourishing and many “recapitalizations” are essentially structured finance transactions with different tranches of risk designed to buy more time and preserve equity. The big unknown is how and when markets will clear. What seems likely is that when they do, we will be in an environment that assumes the era of historically cheap debt is a thing of the past.

Non-Executive Director

swilliams@capright.com